| |  | | | |

Morning Joe

On Thursday, I was on Morning Joe to discuss our continuing jobs crisis, and what I am working on as Chair of the Congressional Black Caucus (CBC). The mission of the Caucus, since our founding in 1971, is clear: "to promote the public welfare through legislation designed to meet the needs of millions of neglected citizens." As the conscience of the Congress, our work is never done.

The CBC is one of the largest and most influential groups in Congress. Being elected Chair has helped me do far more good for our District than bad. Since I have become the Chair, I have had the opportunity to be at the center of many national discussions and be in a better position to push for even more jobs and resources for our community. Because we now occupy the minority, the challenges have been greater, but as you know, I have spent a great deal of my career in Congress reaching across the aisle. Those efforts are more important now than ever.

Over six months into the 112th Congress, no jobs creation legislation has been considered on the House floor despite the introduction of over forty bills by members of the CBC. It is clear that the unemployment numbers throughout the country require effective legislation and tangible action to address the crisis. The reported unemployment numbers in the African American community are hovering over sixteen percent.

The CBC is not standing idly by, but rather with the For the People Jobs Initiative, we are providing all of our constituents with what you need—aggressive action that remedies the stymied economy instead of protecting special interests and embarking on ideological crusades. To address the unemployment crisis and the need for job creation solutions in underserved communities, the CBC has called upon the private and public sectors to immediately remedy the crisis by going into communities with legitimate, immediate employment opportunities for the underserved.

It is time for action on the most important issue of our time—economic opportunity through jobs! Every American deserves the right to be gainfully employed or own a successful business and the Congressional Black Caucus is committed to that right and will not rest until there is parity in access to economic opportunity.

The text of the resolution I have introduced is below.

H. RES. 348

RESOLUTION

Expressing the sense of the House of Representatives that critical jobs legislation should be considered and passed to address the growing jobs crisis throughout America, and for other purposes.

Whereas this resolution may be cited as the `Congressional Black Caucus `For the People' Jobs Initiative Resolution';

Whereas over six months into the 112th Congress and no jobs creation legislation has been considered on the House floor despite the introduction of over 40 bills by members of the Congressional Black Caucus (`CBC');

Whereas the unemployment numbers throughout the country mandate legislative, tangible action to address the crisis;

Whereas the reported unemployment numbers in the African-American community are hovering over sixteen percent and in the double digits in other communities of color in these United States;

Whereas for 40 years the CBC has introduced legislation for the people and has served as the unwavering `Conscience of the Congress';

Whereas the CBC recently launched the `For the People' Jobs Initiative to directly address the lack of jobs for people of color by holding job fairs and town hall meetings throughout the country in areas hardest hit by the recession; and

Whereas, to address the unemployment crisis and the need for job creation solutions in underserved communities, the CBC has called upon the private and public sectors to immediately remedy the crisis by going into communities with legitimate, immediate employment opportunities for the underserved: Now, therefore be it

Resolved, That it is the sense of the House of Representatives that Congress should--

(1) consider and pass critical jobs legislation to address the crisis facing communities of color disproportionately; and

(2) consider and pass critical jobs legislation to address the nationwide economic crisis.

Important Business

Yesterday, two business leaders, US Chamber of Commerce President and CEO Thomas Donohue and Financial Services Forum President and CEO Robert Nichols, warned of the consequences of a default in a USA Today op-ed, putting pressure on Republicans to avoid the catastrophic consequences that would occur.

I don't often agree with these two business leaders, US Chamber of Commerce President and CEO Thomas Donohue and Financial Services Forum President and CEO Robert Nichols, but in this case, I couldn't have said it better myself.

According to Donohue and Nicols, failing to ensure we pay America's bills would mean:

"Government operations halted: Failing to increase the debt limit would require the United States to immediately cease honoring 44% of its obligations during the month of August, according to an analysis by the Bipartisan Policy Center. The U.S. Treasury is expected to take in about $170 billion in tax revenue in August, but needs to pay $300 billion in expenses. The resulting $130 billion deficit would require the government to pick which programs — Medicare, Medicaid, food stamps, unemployment insurance — to pay for and which not to fund. And there would be little money left to pay our troops or to run the courts, the prison system, the FBI, or other essential operations."

"Our debt and deficit would get worse: The ‘full faith and credit' of the U.S. government is regarded as iron-clad and virtually risk-free. As a result, the U.S. government enjoys the lowest borrowing costs in the world… It's been estimated that a one-notch downgrade in the nation's credit rating (the smallest reduction) would raise yields demanded by investors by a full percentage point. Higher borrowing costs mean wider deficits and higher debt levels. Even a one-half percentage point increase in rates would increase our annual deficit by $10 billion in the short run, and by $75 billion per year as outstanding debts roll over."

"Implications for the U.S. dollar: The dollar's role as the world's reserve currency facilitates capital formation, trade, cross-border investment, and economic growth, yielding enormous benefit to U.S. savers, investors, businesses and consumers. In recent years, however, the dollar's status as the reserve currency has been increasingly questioned. Other nations have openly called for an alternative to the dollar. A default and subsequent downgrade of U.S. government debt would likely cause a significant depreciation in the dollar and would accelerate calls for a new non-dollar global reserve currency — to the detriment of every American business, saver, investor and consumer.

"Implications for U.S. economic growth and job creation: Higher borrowing costs and a falling dollar mean slower economic growth and job creation. According to an analysis by the Federal Reserve, a one-percentage point rise in Treasury yields would reduce economic growth by 0.8 percentage points. That number sounds small, but it is not. Economists tell us it would translate into hundreds of thousands of lost jobs every year. After last Friday's bleak unemployment report the last thing in the world we should do is needlessly trigger the loss of even more American jobs."

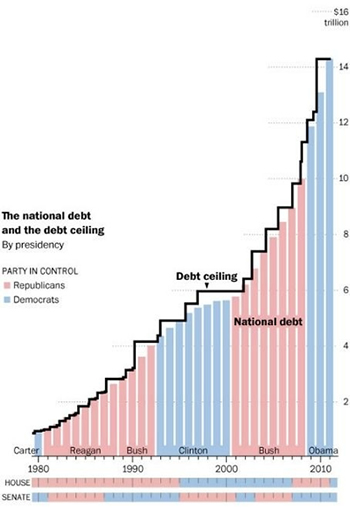

As I have shared with you before, Congress has raised the federal debt ceiling limit 10 times in the past 10 years--under both Republican and also Democratic-led Congresses.

[The Washington Post]

Without another increase, the government will either default on its bonds or have to slash spending by about 40 percent. My colleagues across the aisle are using the full faith and credit of the United States as a bargaining chip--they say they will not vote for an increase without big additional cuts in spending. We need to raise the debt ceiling. Until we do, the Department of the Treasury will do its best to ensure that we meet our obligations, but this can only go so far. On August 2, 2011, we will start to default. And defaulting on our financial obligations, for the first time in history, as President Ronald Reagan once said, would be "unthinkable."

Like most Americans (Republicans, Democrats, Independents, and inbetween), I believe we need a bipartisan, balanced agreement (with spending cuts and revenue increases) to reduce the deficit and rebuild our economy. Where we do make changes, the burden should not be borne by those least able to bear it.

Deadline approaching

If you or someone you know is at risk of foreclosure, please read the below information carefully. If you have further questions, do nto hesitate to call my office at 816-842-4545. The deadline for applications is July 22, 2011.

The deadline for homeowners to qualify for the Emergency Homeowners' Loan Program (EHLP) is rapidly approaching with all Pre-Applicant Screening Worksheets due by Friday, July 22, 2011.

The EHLP, launched by the U.S. Department of Housing and Urban Development (HUD) in conjunction with NeighborWorks® America in June, is designed to help homeowners who are at risk of foreclosure in 27 states across the country and Puerto Rico. The program assists homeowners who have experienced a reduction in income and are at risk of foreclosure due to involuntary unemployment or underemployment, due to economic conditions or a medical condition. Under EHLP guidelines eligible homeowners can qualify for an interest free loan which pays a portion of their monthly mortgage for up to two years, or up to $50,000, whichever comes first.

"The Obama Administration and HUD are committed to providing homeowners with a toolbox of options, such as EHLP, to help keep as many American families in their homes as possible," said HUD Secretary Shaun Donovan. "It is critical that homeowners get pre-screened to qualify for this program by July 22nd so that they are able to take advantage of EHLP before it's too late."

The EHLP funds will pay a portion of an approved applicant's monthly mortgage including missed mortgage payments or past due charges including principal, interest, taxes and insurance. EHLP is expected to aid up to 30,000 distressed borrowers, with an average loan of approximately $35,000.

"With July 22nd right around the corner, we want as many people as possible to apply for this program and potentially help save their homes. For that reason it is imperative that homeowners submit their application by July 22nd in order to find out if they qualify," stated Eileen M. Fitzgerald, CEO of NeighborWorks® America.

The EHLP funds will be offered in the following states: Alaska, Arkansas, Colorado, Hawaii, Iowa, Kansas, Louisiana, Maine, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Mexico, New York, North Dakota, Oklahoma, South Dakota, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming and Puerto Rico.

Only participating EHLP agencies found on www.FindEHLP.org are approved to accept Pre-Applicant Screening Worksheets. Homeowners should beware of scams. It is free to submit a worksheet or get assistance with completing the worksheet. Any company asking for money to assist homeowners with the EHLP application process is a scam. Contact information for participating agencies, the Pre-Applicant Screening Worksheet and more information on the EHLP assistance and its eligibility requirements can be found at www.FindEHLP.org or by calling toll free at 855-FIND-EHLP (346-3345).

In the Kansas City area there are 2 locally based approved agencies accepting Pre-Applicant Screening Worksheets.

The Greater Kansas City Housing Information Center

3210 Linwood Blvd,

Robert J. Mohart Multipurpose Center

816-931-0443 (phone)

816-931-0619 (fax)

www.hickc.org

(Accepting applications from homeowners in Jackson, Clay, Cass & Platte Counties in MO and Wyandotte, Johnson, and Leavenworth counties in KS.)

Harvest America

155 S. 18th Street

Kansas City, KS

913-342-2121 (phone)

www.harvestamerica.org

Follow me on Twitter!

You can now follow me @repcleaver. As always, I look forward to hearing from you.

Click here to add me >>> https://twitter.com/repcleaver

Emanuel Cleaver, II

Member of Congress

| |

|

|  |

| Kansas City Office

101 W 31st St.

Kansas City, MO 64108

Phone: 816-842-4545

Fax: 816-471-5215 | Independence Office

211 West Maple Avenue

Independence, MO 64050

Phone: 816-833-4545

Fax: 816-833-2991 | Washington Office

1433 Longworth HOB

Washington, D.C. 20515

Phone: 202-225-4535

Fax: 202-225-4403

|

|

|

| |

| | |

|