A Bipartisan Success Story

It is a good—and rare—day when I can share with you that Republicans and Democrats came together, both from the House and the Senate, to pass legislation that will be signed by the President and supported by many organizations. Yesterday, by a vote of 405 to 16, the House successfully passed H.R. 674, to repeal the 3 percent withholding requirement for contractors engaged in business with federal, state, and local governments. For many businesses affected by this mandate, the profit margin is often less than 3%. The withholding tax would have created significant cash flow problems for day-to-day operations as well as drain capital that could be used for job creation and business expansion.

I was proud to cosponsor and vote for this legislation, which was supported by hundreds of businesses, trade associations, and local governments, including the Associated Builders and General Contractors of America, the U.S. Chamber of Commerce, the Financial Services Roundtable, National Underground Contractors Association, the National Association of Manufacturers, the National Association of Counties, U.S. Conference of Mayors, the National Association of State Procurement Officials, the American Farm Bureau Federation, the Edison Electric Institute, the American Society of Civil Engineers, the American Institute of Architects, and many others.

This is all good news, but the country needs great news. Congress should be acting on the President's full American Jobs Act – doing so will immediately create jobs and strengthen economic growth by helping small businesses grow and hire, providing tax relief for workers and families, putting people back to work rebuilding America, and preventing the layoff of teachers, firefighters and police officers. We all support stopping the administrative headaches and the reduction in cash flow that businesses could face under this withholding requirement, but this bill is not a significant or immediate job creator.

Food Stamp Challenge

Congressman Cleaver, standing with Jim Winkler, General Secretary of the General Board of Church & Society of the United Methodist Church, Father Larry Snyder, President, Catholic Charities USA, Rev. Peg Chamberlain, President, National Council of Churches, and Delegate Donna Christensen (VI)

On Thursday, I joined with national religious leaders, Members of Congress, Senior White House Administration officials, and current Supplemental Nutritional Assistance Program (SNAP, formerly Food Stamps) recipients just off the Hill at a DC Safeway supermarket for a press conference and shopping trip for a week's worth of groceries on the average SNAP allotment of $31.50. With my colleagues in Congress considering cutting the budget for SNAP, I was proud to stand with people of many faiths, who are leading an effort to focus the country's attention on the realities of hunger and poverty.

The national event marks the beginning of the 4th annual Fighting Poverty with Faith mobilization. Fighting Poverty with Faith, cosponsored by the Jewish Council for Public Affairs, Catholic Charities USA, and the National Council of Churches, which includes more than 50 national faith organizations brought together by shared traditions of justice to act on behalf of those living in poverty in America.

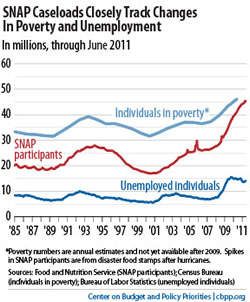

I grew up in public housing, but we never knew we were poor. My mother would bring home food from the family she worked for, when they allowed her to. My grandfather would bring us vegetables he had grown. These days, it is different. People are struggling more than ever before, and SNAP, which stands for Supplemental Nutrition Assistance Program, is one of the biggest ways we can help those in need. In the past year (2010-2011), SNAP provided more than 45 million Americans with much-needed food; more than half of these were children. Without SNAP, those millions would have gone hungry and faced serious nutritional and other health issues.

Before the late 1960s, when the federal government began providing nutrition assistance, hunger and severe malnutrition could be found in many low-income communities in the United States. Today, in large part because of these programs, such severe conditions are no longer found in large numbers. To promote efficiency, the SNAP has one of the most rigorous quality control systems of any public benefit program, and has achieved its lowest error rates on record in recent years. USDA reports that fewer than 2 percent of SNAP benefits are issued to households that do not meet all of the program's eligibility requirements. The Food Stamp Challenge is important in 2011 for several reasons. Food stamps and many other federal feeding programs are facing steep cuts and possible restructuring in the federal FY2012 budget. These cuts would severely restrict many families' access to healthy food and could also limit spending, thus impeding economic growth. Block granting the food stamp program would greatly restrict its flexibility, which could prove traumatic for many families in the event of another economic recession or economic disaster.

Additionally, the Farm Bill - the umbrella bill under which the food stamps program is authorized – is scheduled to be reauthorized in 2012. This reauthorization process will set the direction for the future of the food stamp and other feeding programs, so it is important to raise the profile of federal feeding programs now and show the vital service they provide to millions of Americans and American children. Votes called me away from the shopping trip, but I will be watching what I purchase and eat this week, in keeping with the theme of the Food Stamp Challenge. It will be tough, but no tougher than the struggle families in need face every week.

Support for Students, both Old and New

On October 25, 2011, the Administration introduced a new "Pay As You Earn" proposal that will reduce monthly payments for more than one and a half million current college students and borrowers. Starting in 2014, borrowers will be able to reduce their monthly student loan payments to 10 percent of their discretionary income. Many students need relief sooner than that. The new "Pay As You Earn" proposal will allow about 1.6 million students the ability to cap their loan payments at 10 percent starting next year, and the plan will forgive the balance of their debt after 20 years of payments. Additionally, starting this January an estimated 6 million students and recent college graduates will be able to consolidate their loans and reduce their interest rates.

Current law allows borrowers to limit their loan payments to 15 percent of their discretionary income and forgives all remaining debt after 25 years. However, few students know about this option. Students can find out if they are currently eligible for IBR at www.studentaid.ed.gov/ibr. Last year, the President proposed, and Congress enacted, a plan to further ease student loan debt payment by lowering the IBR loan payment to 10 percent of income, and the forgiveness timeline to 20 years. This change is set to go into effect for all new borrowers after 2014—mostly impacting future college students.

Current college students now have the chance to limit loan payments to 10 percent of their discretionary income starting in 2012. In addition, the debt would be forgiven after 20 years instead of 25, as current law allows. For many who struggle to manage their student loan debt – including teachers, nurses, public defenders and others in lower-paying jobs – these proposed changes could reduce their payments by hundreds of dollars each month. Overall, this proposal would provide an estimated 1.6 million borrowers with more manageable monthly payments.

The Administration is also planning to offer student borrowers the chance to better manage their debt by consolidating their federal student loans. Today, approximately 5.8 million borrowers have both a Direct Loan (DL) and a Federal Family Education Loan (FFEL) that require separate payments, which makes them more likely to default. To address the needs of these borrowers, the Administration will allow borrowers the convenience of a single payment to a single lender for both loans. Borrowers who take advantage of this consolidation option, which begins in January, would also receive up to a 0.5 percent reduction in their interest rate on some of their loans, which means lower monthly payments that would save hundreds of dollars in interest. Eligible borrowers will be contacted by their federal loan servicer early next year with information on how to consolidate.

Starting from, and Ending with Civility

Recently, I began sharing a message of civility with my House colleagues. I hope to continue this habit, and I would also like to share the words I wrote, simple though they may be, with you.

- As we attempt to breach the divide in Congress, I wanted to share an insightful civility story:

Two young boys went to a neighborhood park to have some play time before their respective mothers called them in for dinner. But upon arriving, a controversy ensued. One boy said, "Let's play on the seesaw." "No," the other replied, "I want to play catch." One boy got on the seesaw but because no one sat on the other end, he never got off the ground. The other boy threw the ball but no one threw it back.

That sounds a lot like the two sides in Congress. Both sides have come to Washington for the same purpose, but with different priorities. As representatives of the people of the greatest nation on earth, we must be willing to alter one preference in order to acquire another, often resulting in the accommodation of both.

-

-

Follow me on Twitter!

You can now follow me @repcleaver. As always, I look forward to hearing from you.

Click here to add me >>> https://twitter.com/repcleaver

Emanuel Cleaver, II

Member of Congress

| |

|